Lets take a look at some of the key presentations from the

SEMI Summit that took place in January in Grenoble.

Gartner – 3D Market

Forecast

Stromberg of Gartner gave a market forecast of greater than 1.5M

300mm wafer equiv per month or 2B units / year of 2.5/3D (non MEMS non CIS) by

2018 but then listed several pages worth of technical issues that could affect

the forecast.

Editorial Comment:

In emerging technologies like 2.5/3D guaging market timing and size is an art, not

a science but I’m not sure what numbers like this are worth if you preface them

by saying they could be impacted by thermal issues, yield issues, design

issues and competitive treats by PoP and WB devices. Of course all those things are

true, but then what kind of confidence do we have in the numbers / timing

? This is true for all the marketing

houses not just Gartner.

GlobalFoundries

GF has been detailing their imminent commercialization of 2.5/3D IC for several years. Their current status report is shown below.

Their response to Interposer TSV formation, front side

routing and backside reveal and RDL

issues are shown below. High IO counts require dense interposer

frontside routing (i.e. over 1600 wires for a HBM port.

The GF supply chain for 2.5D productization is shown below:

TSMC

Miekei Leong , VP TSMC, gave the standard TSMC CoWoS pitch

but did offer a definition of their supply chain model where OSATS are now

integrated as part of the supply chain.

Another interesting roadmap showed TSMC demonstrating HBM

(high bandwidth memory) on CoWoS by 4Q 2014.

IMEC – Cost Analysis

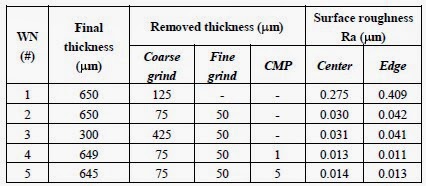

Eric Beyne of IMEC presented data on a cost breakdown of

their 5 x 50µm TSV full flow 3DIC process (without stacking) showing the TSV

middle fabrication process and the thin and backside reveal processing are

about equivalent in cost.

They find that a lot of cost

is invested in CMP processing which can be improved by reducing the Cu

overburden after TSV fill.

This can be compared to the

10 x 100µm TSV costs presented by Ramaswami of Applied Materials shown below:

For all the latest on 3DIC

and advanced packaging stay linked to IFTLE……………..